Jayanagar 3rd Block East Bangalore-560011, Karnataka India

News details

Modern Treatments in Health Insurance

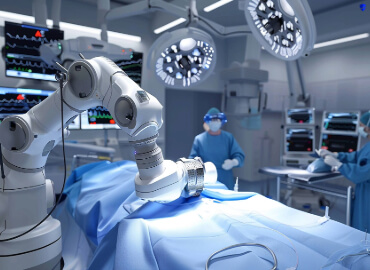

Modern treatments in health insurance now include state-of-the-art medical procedures that treat conditions once thought incurable. These breakthrough treatments give new hope to patients through amazing technologies like:

These treatments stand out because they barely intrude on the body. Patients bounce back faster than they would from traditional open surgeries. The advanced procedures also work better to manage health conditions like cancer. The Insurance Regulatory and Development Authority of India (IRDAI) took a big step in 2019. They made insurers cover specific modern treatments. Many health insurers used to deny coverage for these procedures and called them 'experimental'. These modern treatments use customized approaches to patient care that work better for severe health conditions. The sophisticated technologies and expertise needed make these advanced procedures cost more. Doctors can give these treatments in two ways. They either admit patients for 24-hour care or treat them in daycare without overnight stays. Health insurance covers these treatments to make them affordable and available to patients who need them.

Does Modern Treatment cover under Health Insurance?

Your health insurance covers modern treatments! The Insurance Regulatory and Development Authority of India (IRDAI) made this mandatory back in 2019 for all health insurance policies to cover specific modern treatments.

These treatments can be covered as in-patient procedures that require 24-hour hospitalization or as daycare treatments. All the same, you should know that insurance companies may set certain sub-limits on these treatments even though coverage is mandatory.

To cite an instance, see how some insurers might cover up to 50% of the sum insured for modern procedures. Some policies may restrict oral chemotherapy coverage to 20% of the sum insured, with a maximum cap of Rs. 2 lakh.

A qualified medical practitioner must prescribe the treatment in writing to claim coverage for modern treatments. The treatment should meet your policy's medical necessity requirements under the terms and conditions.

Benefits of Modern Treatment

Modern treatments reshape the healthcare scene with evidence-based practices and advanced technologies. Patients who receive continuous modern treatment see lower direct medical costs - USD 6,192 compared to USD 8,361 with standard treatment.

These are the benefits you'll get from modern treatments:

The effect on healthcare costs looks promising. Modern treatment approaches save about USD 3 billion in yearly healthcare costs. These treatments have shown amazing results in treating conditions that doctors once thought untreatable. Modern treatments make your healthcare journey smoother. Advanced approaches help detect diseases early and monitor various conditions remotely. This works especially well when you have chronic conditions like hypertension, diabetes, and asthma. Evidence-based practices in modern treatments have proven their worth through positive returns on investment for healthcare systems. You get treatments that work better and save both time and resources. Your care plan becomes unique with modern treatments. They look at your specific traits, including genetics, environment, and lifestyle factors. This creates targeted interventions that work better and stay safer. This individual-specific approach ended up giving better treatment results and happier patients.

List of Modern Treatments Covered by Health Insurance

Your health insurance policy now covers 12 cutting-edge medical treatments that IRDAI requires insurers to include.

The coverage typically includes:

These treatments come under either in-patient procedures or day care treatments. Your policy's specific terms determine the coverage amount, and insurers often set sub-limits for certain procedures. A qualified medical practitioner must recommend these treatments in writing for insurance coverage. The policy includes these modern treatments, but some insurance plans need you to wait 2 to 3 years before covering specific procedures.

Choosing the Right Health Insurance for Modern Treatments

You need to assess several factors when picking the right health insurance for modern treatments. A policy should give you detailed coverage without restrictive limits.

Here's how to pick the best coverage:

Additional Considerations:

Note that you should review the policy documents and clarify any unclear terms. Contact your insurer if something isn't clearly stated in the policy.

Conclusion

Medical treatments have revolutionized healthcare delivery. Previously incurable conditions are now treatable with reduced costs and faster recovery times. Your health insurance now covers 12 advanced procedures, though policy terms and limits will apply.

New treatments give patients clear benefits through customized care and cost savings. Research shows modern methods can save USD 3 billion each year in healthcare costs and lead to better outcomes for patients.

The right insurance policy is vital since coverage terms differ among insurers. Look at sub-limits, waiting periods, and network hospitals before you select a health plan. A detailed policy will give you access to advanced treatments without straining your finances.

Smart planning starts with knowing your coverage options. Visit https://basketoption.insure/health-insurance, the best insurance broker in Bangalore, can help you explore modern treatment coverage in health insurance. Expert advice and competitive quotes are a great way to get state-of-the-art healthcare—reach out to us today! Good insurance coverage for modern treatments protects your health and finances. Understanding your policy details and checking procedure coverage before you need them will keep you prepared.

Frequently asked question

Understand your insurance policy options. Identify the best value. Enjoy peace of mind.

?What are modern treatments in health insurance

Modern treatments in health insurance refer to advanced medical procedures that use cutting-edge technologies like AI, robotics, and nanotechnology. These treatments are typically minimally invasive, offering faster recovery times and more effective options for managing various health conditions.

?Are modern treatments covered by health insurance in India

Yes, since 2019, the Insurance Regulatory and Development Authority of India (IRDAI) has mandated that all health insurance policies must cover 12 specific modern treatments. These include procedures like robotic surgeries, immunotherapy, and stem cell therapy.

?What are the benefits of modern treatments

Modern treatments offer several advantages, including reduced recovery time, personalized treatment approaches, enhanced diagnostic accuracy, and improved quality of life. They can also lead to lower direct medical costs and significant savings in annual healthcare expenses.

?How do I choose the right health insurance for modern treatments

When selecting health insurance for modern treatments, verify that the policy covers the specific treatments you might need, examine sub-limits, compare multiple plans, consider add-on coverage, ensure adequate sum insured, and check the network of hospitals offering these treatments.

?Are there any limitations to coverage for modern treatments

While coverage for modern treatments is mandatory, insurance companies may impose certain sub-limits. Some insurers might cover up to 50% of the sum insured for these procedures. Additionally, there may be waiting periods ranging from 2 to 3 years for specific treatments.